Savers and investors alike have been stuck for choice since interest rates have languished at 0.5 per cent for now almost 3 years. So what to do?

The problem for savers, unlike investors who can afford to lose their investment, is compounded as alternatives usually come with greater risks and not so transparent transaction costs. Accounts outstripping inflation may require savers to squirrel their money away for at least 3 years – though for most people this is just fine. Savers should avoid riskier assets and be wary of being misled by banks into buying inappropriate products. Most banks will make more than you out of the deal.

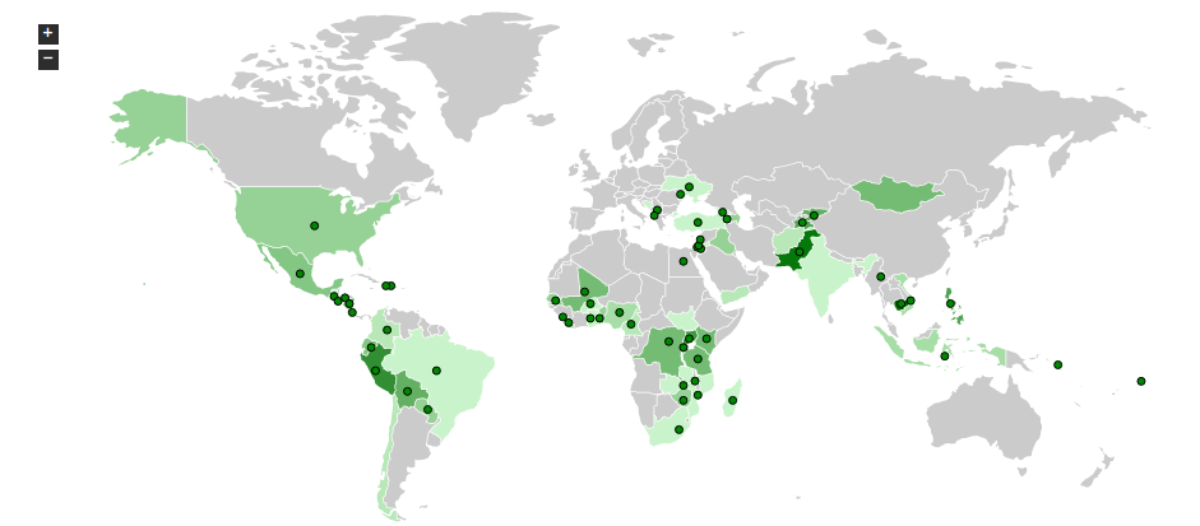

But for investors seeking a slightly higher return there’s been a quiet revolution in something called social or peer to peer lending. Here’s what people have been saying about Zopa.com, which is a bit like Kiva. Both social lending platforms connect borrowers with lenders and have remarkably low default rates. Kiva doesn’t give you a return on your investment for you are growing human capital in the developing world instead, but you can get your capital back over time.

Zopa on the other hand is much more sophisticated. Here’s what THEY say about their model:

Peer-to-peer lending is a … fairer and more human way of doing money. It’s like borrowing and lending with your friends and family – except there are thousands of people you can lend and borrow with.

… lenders and borrowers get better rates, because peer-to-peer lending is more efficient than the traditional banking model.

… Banks use your money to make even more money for themselves. They lend some of it out, gamble some of it on the price of tin or the Yen depreciating, and invest the rest in any other money-making schemes they can think of.

… at Zopa, people who have spare money lend it directly to people who want to borrow. There are no banks in the middle, no huge overheads and no unethical investments.

I’ve been lending with Zopa for about three years. Not much simply because I don’t have much to spare, but the return has been 6.7%

So why recommend it? here’s what they say:

Great rates: Returns over 5.7% pa (after charges and actual average annualized defaults, over last 12 months)

A proven track record: We have lent over £190 million of savers’ money and have 30,000 happy lenders.

Responsible: Zopa borrowers have the best credit ratings and borrow only what they can afford.

If it’s good, share it: Nearly all Zopa’s lenders have joined after a recommendation from a friend.

Lenders should be investors rather than savers, not so much because it is risky – it is not in the great scheme of things – but because you need to be fairly numerate and computerate to get the hang of the (very clever) system.

And a final thought. Zopa are offering people like me a £100 for every friend who invests £2k. Go check it out.

Now, if anyone does sign up I will re-lend every £100 I get on Kiva for as long as I can.