When someone offers you an incentive of say $25 to lend on Kiva, you might think there was a scam. Why would anyone give you money to lend out and then potentially take it back when it was repaid? I’ve not read the small print, so this may not be possible, but it is interesting to know how much organisations are prepared to pay to get an extra customer.

Author: @ourlocality

Frustrated investor?

Savers and investors alike have been stuck for choice since interest rates have languished at 0.5 per cent for now almost 3 years. So what to do?

The problem for savers, unlike investors who can afford to lose their investment, is compounded as alternatives usually come with greater risks and not so transparent transaction costs. Accounts outstripping inflation may require savers to squirrel their money away for at least 3 years – though for most people this is just fine. Savers should avoid riskier assets and be wary of being misled by banks into buying inappropriate products. Most banks will make more than you out of the deal.

Continue reading “Frustrated investor?”

Model the madness

Here at Kivaclub we are interested in numbers behind the current financial market madness. Why e.g. is it that Japan is so much more indebted than Italy, but can borrow at just 1%? The Economist stated somewhere that Italy is basically not insolvent, so one argument is that markets are forcing political change, but undemocratically. See for yourself what happens if you increase the cost of country borrowing by running your own ‘what if scenarios’ using the Economist’s handy calculator below.

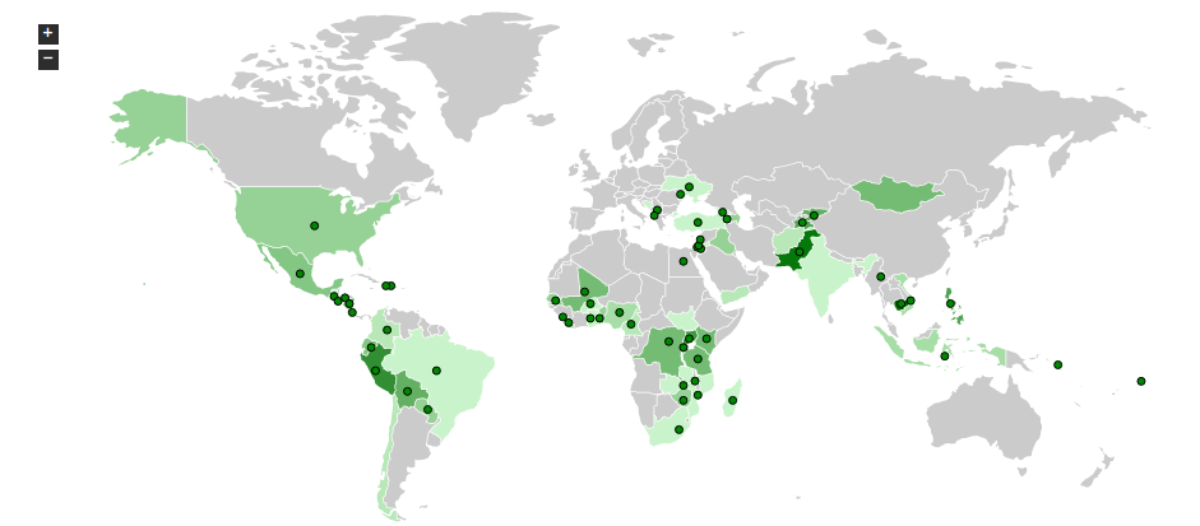

620,000 lenders fund 615,000 entrepreneurs, students, and other microfinance borrowers

Five+ years of Kiva loan activity, in full color. Are you on the map?

http://vimeo.com/28413747

To Catch A Dollar

How Kiva Works

Every so often, I get an email like the following from Kiva, the micro loans lending network, which gives me a summary of my loan repayments to date and opens up the option of re-lending and making my money work harder. Why not give it a go? Join the club.

It’s not too late to send a Xmas present!

Buy a Kiva Gift Card – the thinking person’s gift!

When you give a Kiva Card, you’re giving the power to change lives.

How cool is that?

Options:

Email a Kiva Gift Card (phew!)

Print a Kiva Gift Card at home!

Post a Kiva Gift Card by snail mail (US friends and relatives only!)