Earlier this year – or was it last year? – I got an email to participate in a short survey looking at the feasibility of a microfinance setup similar to Kiva, but operating in the UK. It seemed to me the had mileage. Some months later it looks like Julian Lewis has come up with his response LendLocal. Here is what Julian has to say about his new idea:

LendLocal is a new form of social investment. It gives you the chance to make a difference to the UK’s most disadvantaged communities.

How? By making loans to people and businesses the banks can’t be bothered with – not bad businesses or dodgy people, but those who miss out because of ‘postcode lending’.

Banks aren’t keen on lending in poorer areas, no matter how good a borrower’s prospects. They’d rather just go where their computers tell them (even if that means losing lots of money, as we’ve all seen).

Like Kiva LendLocal connects you to borrowers, except these could be in your own community or elsewhere in the UK, perhaps because the banks won’t lend.

Like Kiva the lending is not completely disintermediated. The stress is taken out of the process and you don’t have to work out who’s a safe bet as the loans were made originally by a community development finance institution (CDFI) or a credit union. Obviously your loan principal is at risk when you lend through LendLocal, but credit unions are credible organisations that know about lending money.

Like Kiva you will not get interest on your loan.

However, and I had not worked this out myself, if you relend your money for a while, you’ll qualify for very generous tax relief.

According to Julian lending through

LendLocal will give you the satisfaction of supporting local people – people here in the UK who the banks gave up on because of where they live and work.

If you are new to microfinance, listen & watch here:

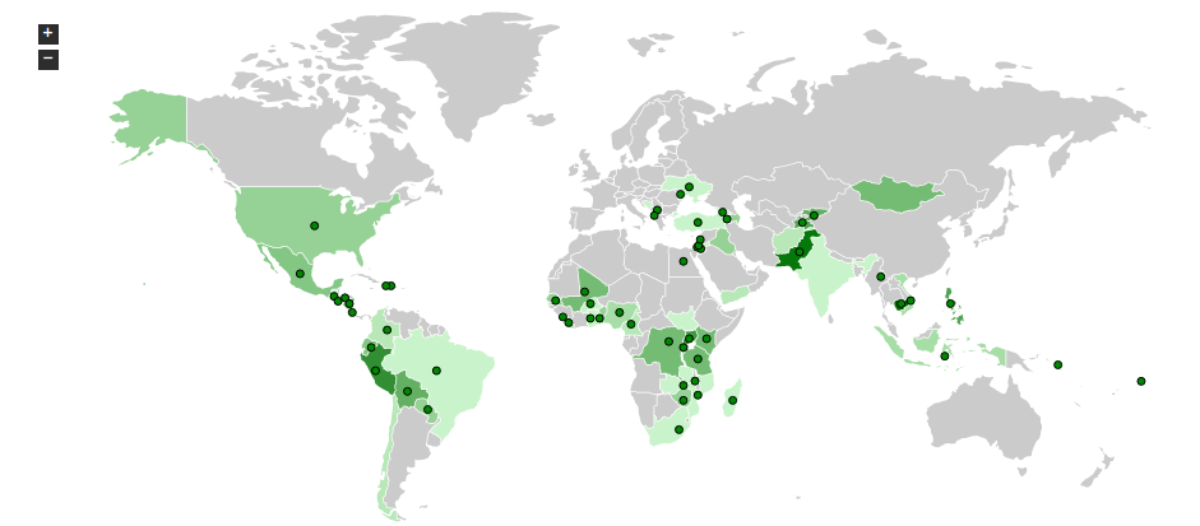

Afterword: The only question I have is why doesn’t Kiva lend in the UK? It lends in the USA, so why not here? Will this undermine LendLocal’s proposition? As a lapsed Zopa lender and fan, to my mind the gap in the market is in a peer to peer lending platform using a model closer to Zopa, but which lends to higher risk borrowers, and gives a financial return as well as a social return to the investor.