Normally at OurLocality we frown on the use of triple exclamation marks, capitalisation, emoticons and childish fonts. It just isn’t grown up and it looks SPAMMY.

Normally at OurLocality we frown on the use of triple exclamation marks, capitalisation, emoticons and childish fonts. It just isn’t grown up and it looks SPAMMY.

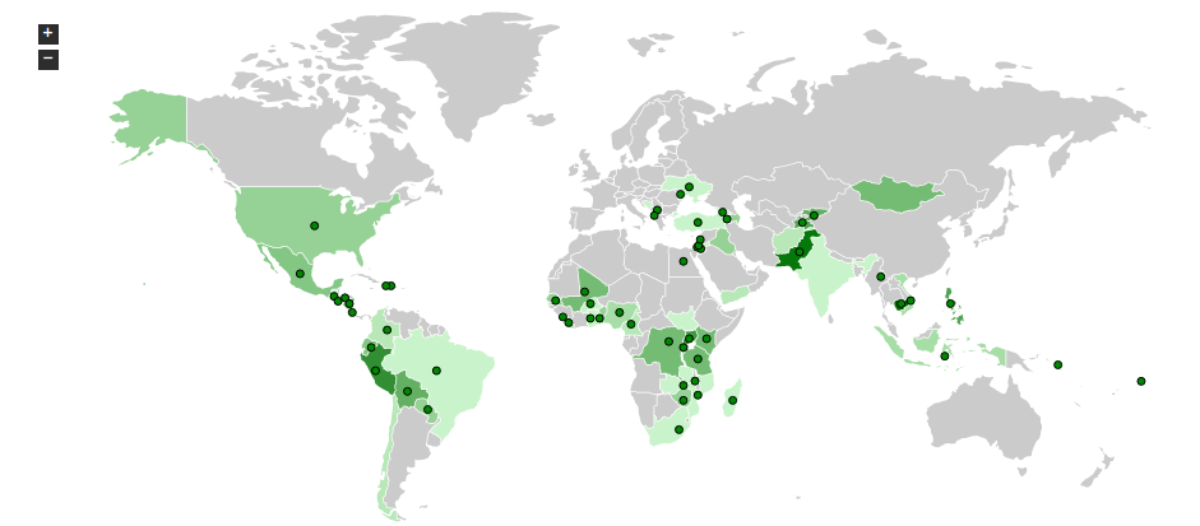

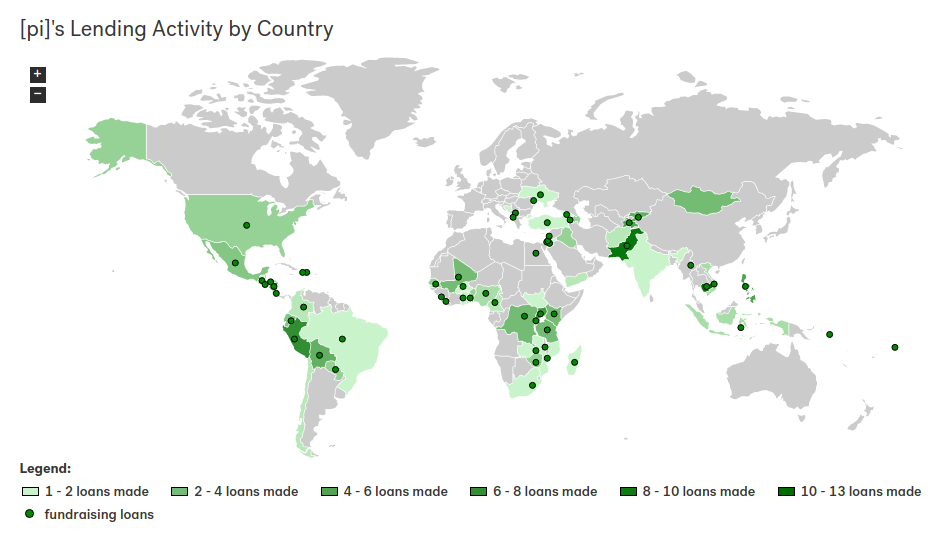

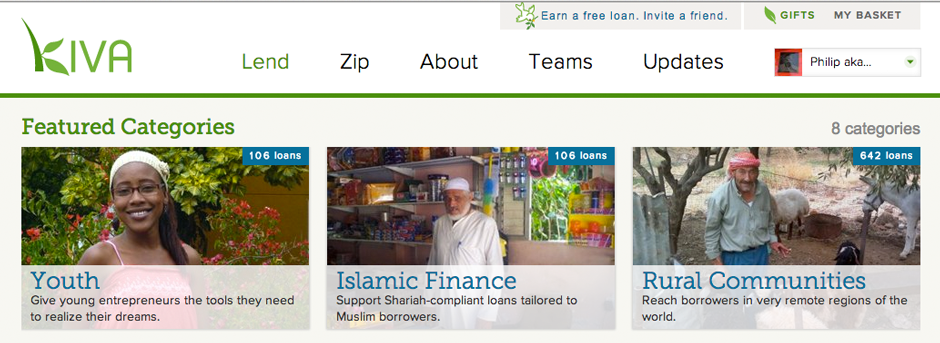

But this isn’t some pyramid scheme, but a simple cost of marketing lesson. Kiva – one of my favourite lending platforms – has obviously calculated that the cost of getting a new lender on its platform is more than $25, so it is using people like me to invite new lenders to the scheme.

How? By offering $25 for them to lend to whomever they wish in the hope they will lend more, once hooked (small print you cannot get this back for yourself – nice thought, but you can re-lend it again and again). The odds of you getting your money back are decidedly higher than on Betfred or similar online purveyors of misery.