Trees within Conservation Areas are protected by legislation, ensuring the preservation of our natural, historical and cultural heritage. Apparently, and I never knew this, it is an offence to fell, lop, top, or carry out any work on trees within a Conservation Area without permission. Conviction of an offence could result in a fine of…

If you are a listed property owner, why not have your say on VAT. Currently VAT is chargeable at 20% on almost all repairs and maintenance works, whereas the building of new properties is exempt. Harlow Consulting is working with Historic Environment Scotland to explore how refunding VAT on extensions, repairs and maintenance would affect…

Expressions of interest from property owners for potential repair projects are now invited. The deadline for applications for the first round of funding is Friday 24th February 2023. Future rounds of funding will be advertised in due course. A free Dunbar CARS introduction event will take place on Wednesday 15th February in the Community Room of…

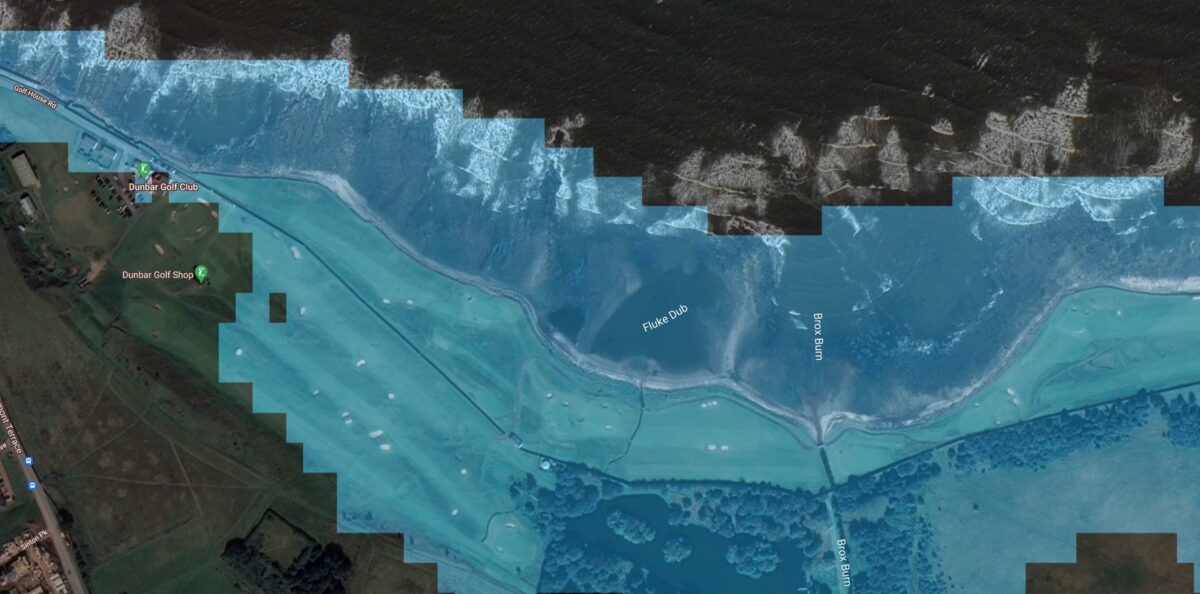

John Muir Link – Coastal Path

There is a path from Dunbar to Whitesands, and beyond, today known as the John Muir Link. At some point in the late 19th Century an esplanade was created, in the hey day of the big hotels, which have since been demolished. The esplanade itself has seen better days, but nonetheless gives access to a…

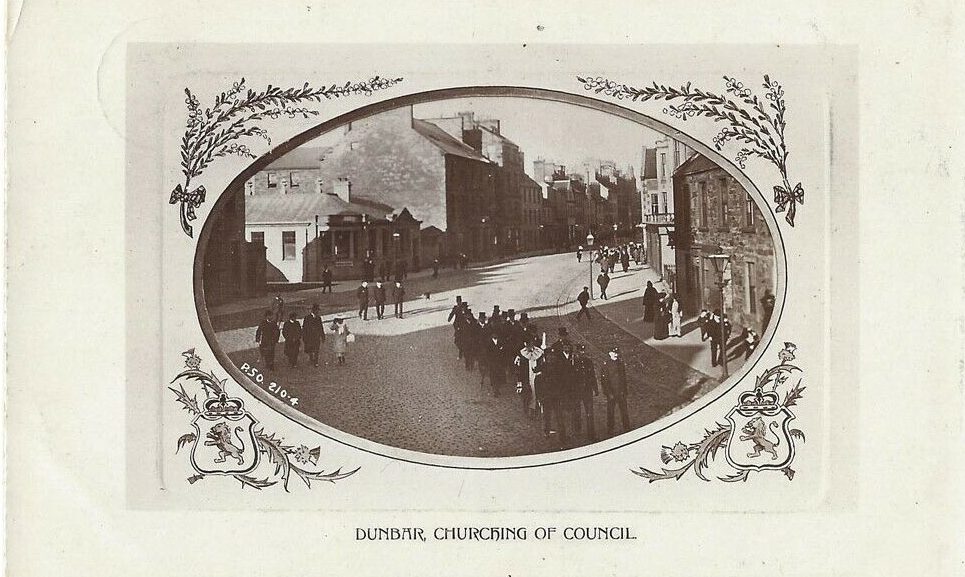

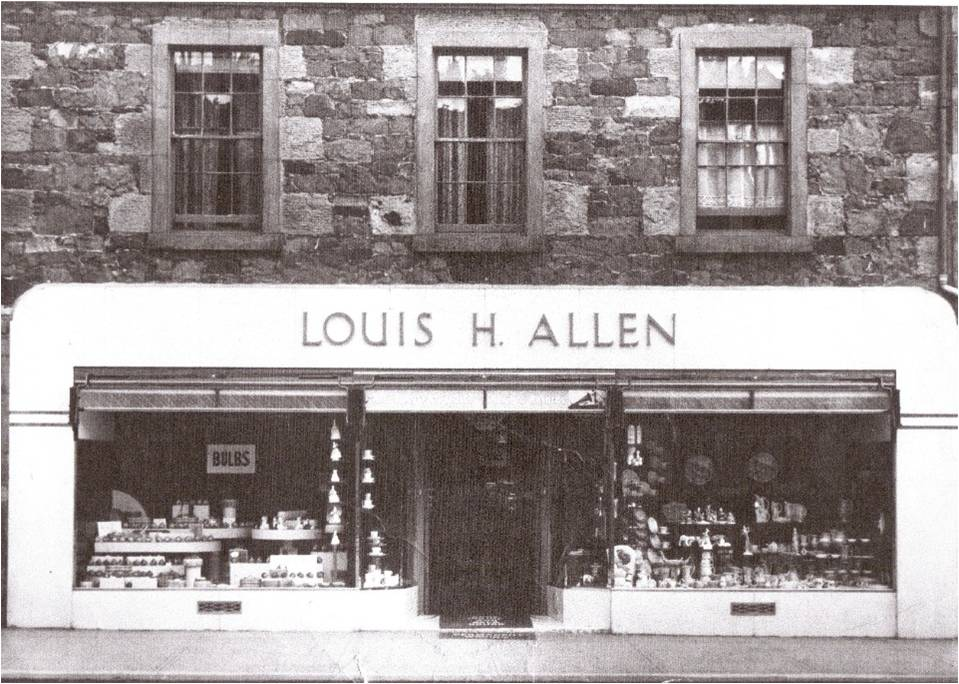

Old Postcards Found

Take in a hotchpotch of architectural and industrial history, 2 battle sites, and the vanity of the Earl of Lauderdale via some old postcards and photo finds.

21 & 25 High Street

The building at numbers 21 and 25 High Street Dunbar looks uninteresting unless you head round the back or delve into old photo and postcard archives. The tenement conceals its history well, for it is in fact late 18th century and merited a C-listing back in 1971.

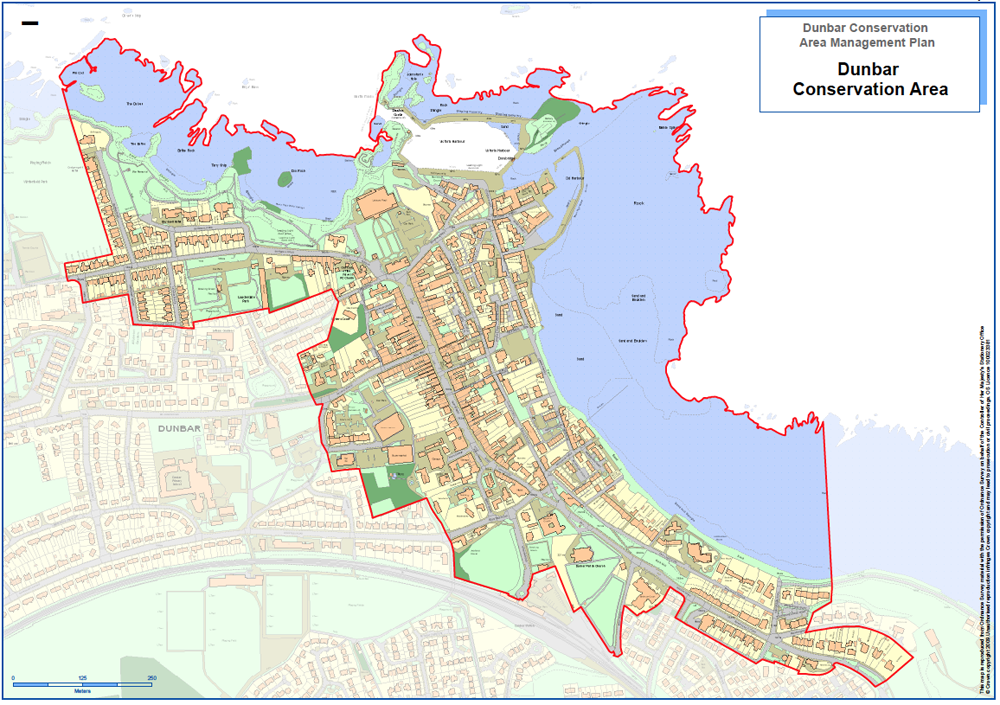

Is there a Conservation Area in Dunbar?

Yes. Most of the older parts of Dunbar, though not all, are in the Dunbar Conservation Area [1] Dunbar has one of 30 conservation areas in East Lothian, which sounds like quite an achievement, but there are 600 in Scotland. Planning authorities designate Conservation Areas in Scotland, which have a combination of special architectural and…

Walter Robertson Architect

Dunbar Post Office by Walter Robertson A new Post Office for Dunbar was commissioned by HM Public Works and completed in 1904. The Post Office, now numbers 32 and 32a High Street, Dunbar is attributed to the eminent public works architect Walter Wood Robertson, notable for contributions that include the Royal Observatory in Edinburgh. Of…

Buildings at Risk: Toolkit

The Buildings at Risk Toolkit is part of an initiative funded by Historic Scotland and managed by The Architectural Heritage Fund. It explores and guides on ways to tackle Scotland’s most endangered historic buildings. The Toolkit comprises advice on a range of matters relating to buildings at risk and should be of value to anyone…

Old Buildings Free Technical Advice Line

Call the Technical Advice Line on 020 7456 0916. Weekdays 9.30am-12.30pm https://www.spab.org.uk/advice/technical-advice-line The Society for the Protection of Ancient Buildings’ (SPAM) advice line is a free and confidential service open to anyone with a technical enquiry relating to old buildings. Helpline advisors are qualified building surveyors and architects who answer over 1000 calls a year…

You must be logged in to post a comment.